|

A premier provider of passionate and enthusiastic solutions-oriented income and estate tax preparation services as well as general financial, target marketing and entrepreneurial hourly consulting services to individuals and emerging and established businesses in Virginia, North Carolina, Maryland and the District of Columbia. Our ears are not just sympathetic; they are experienced, both personally and professionally. Unusual situations, performing arts and media-related industries are among our specialties.

|

|

Phone: Mailing

Address: Email: |

|

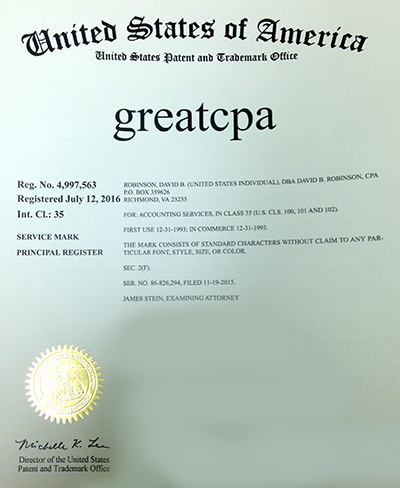

History of David B. Robinson, CPA--Personally and Professionally David B. Robinson, CPA is the only person legally that is authorized in the United States to refer to themselves as a GreatCPA® -- He is the Brand! On July 12, 2016 after using the service mark "GreatCPA" since 1993 and having secured the service mark ("sm") in Virginia then, David was awarded the Registered Service Mark GreatCPA® by the United States of America Patent and Trademark Office (Registration Number 4,997,563). An extremely well-rounded CPA whose greatest strength is that he has actually done and participated in what most other CPAs only consult and advise about. He comes from a family of Virginia and Scottish entrepreneurs, including one that opened an architectural office on Born in In early 1990, David B. Robinson, CPA founded a sole proprietorship accounting and business consulting firm, "David B. Robinson, CPA," operating from a home office with five clients. Through his own marketing effort, the Firm had about 30 clients two months after the commencement of operations. By December 1990, with another significant increase in the number of clients forthcoming during the busy tax preparation season, David B. Robinson, CPA moved to a one-room office location in retail space in Back in 1994, in the early days of the Internet, David's website, www.GreatCPA.com, won an award from Harcourt Brace Professional Publishing Company as one of the "Top 5 Accounting Websites." From 1999 to 2002, he hosted and produced almost 300 live radio shows on several By August 2005, Robinson's firm had grown to approximately 1,300 clients with seven part-time employees. Robinson sold his firm to a larger firm because he wished to take advantage of other opportunities that had been presented to him. Robinson retained a core group of tax preparation clients and began to pursue those other entrepreneurial interests. After the acquisition of his large Midlothian-based firm, Robinson started a new company--Custer Robinson, LLC--first headquartered in Petersburg, Virginia and now (effective September 2007) headquartered in Richmond's Fan District near Virginia Commonwealth University. In September 2005, concurrent to the founding of Custer Robinson, LLC, Robinson accepted the position of Vice President and Chief Financial officer of a Midlothian-based management and holding company for four In March 2007, Robinson left his position with the restaurant group and began to add more tax preparation clients to the core group of Custer Robinson, LLC clients. With the expiration in September 2008 of a covenant-not-to-compete that had been placed on him when he sold his In January 2008, he accepted the part-time salaried position of Acting Chief Financial Officer of CenterStage Foundation, a 501(c)(3) non-profit whose principal mission was the construction of a $90,000,000 (inclusive of all construction, soft and general and administrative costs) performing arts complex in downtown Richmond. His primary duties involved negotiation of the Federal and Virginia Historic and Federal New Market tax credit portions of the financing of the project. Ancillary duties involved establishing and maintaining internal financial controls for the Foundation and serving as a brainstorming partner for the Treasurer and other officers. He was responsible for overall financial statement preparation, external audit management and pledge and cash flow forecasting. In November and December 2008, he was personally responsible for the final execution of the documents relating to the receipt of approximately $21,500,000 in equity from tax credit investor-partners. In late December 2008, he was the authorized signer of all tax credit documents for the for-profit, wholly-owned subsidiary of the Foundation, Richmond Performing Arts Center, Inc. In June and July 2009, he oversaw the production of a Balanced Budget for Fiscal Year 2010 and stepped down September 30, 2009 after the Facility held its Grand Opening as a fully-functional performing arts venue. Commencing in October 2009, Robinson began to accept more tax preparation and consulting clients to add to his now Richmond-based firm, Custer Robinson, LLC. Though he has been an editorial adviser to two national magazines, the Journal of Accountancy and LaPosta, he is also a writer himself. His first paperback booklets, written in 1977 about his great-grandfather, Charles M. Robinson, a master He wrote a weekly newsletter about entrepreneurialism from 1993 to 2005 (over 620 issues) and has written two small paperback pamphlets (production run 10,000 each) entitled "Tales, Ideas and Quotes from a GreatCPA™" that were distributed on college campuses nationwide. He has been compiling many of his ever-evolving entrepreneurial thoughts in an as-yet unpublished manuscript entitled Tales, Ideas and Quotes from a GreatCPA®--THE BOOK! In October and November 2010, he briefly served as Transition Chief Financial Officer of 4U2U Brands, LLC, a Richmond-based beverage bottling company. In the Fall of 2011, he briefly served as Transition Chief Financial Officer of Dominion Construction Partners, LLC. In the Summer of 2012, he served as Acting Chief Financial Officer of The Virginia Center For Architecture, now known as the Branch Museum of Architecture and Design. He has been nationally recognized for his expertise in marketing and as a Certified Public Accountant. In 1997 Inc. magazine chose the Accounting and Business Consulting Firm of David B. Robinson, CPA as a finalist in its "Marketing Masters" award competition. Robinson was selected by the United States Government's Small Business Administration as its 1998-1999 Virginia Accountant Advocate of the Year. Robinson was selected by Virginia Business Magazine in 2002, 2004 and 2005 as a "Super CPA," a designation conferred by CPAs upon fellow CPAs. Approximately 2-3% of Virginia CPAs receive this award each year. Robinson is a seasoned public speaker and guest lecturer. He has previously taught Principles of Accounting at the college level as an adjunct professor, but currently confines his classroom activities to guest lecturing for a select group of professors. He also consults with other CPAs about target marketing and practice management issues. Volunteer board memberships, appointments and voluntary and elected positions—past and present--are extensive: |

|

Read

about David's

Great Grandfather's

Historic Architecture